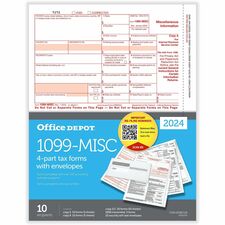

Office Depot® Brand 1099-MISC Laser Tax Forms And Envelopes, 4-Part, 2-Up, 8-1/2" x 11" , Pack Of 10 Form Sets

Take the stress out of tax time with the Office Depot Brand 1099-MISC Laser Tax Forms And Envelopes. These tax forms are made of acid-free paper and heat-resistant ink to help prevent yellowing and fading, and they're compatible with most accounting software programs for your convenience. File Form 1099-MISC for each person in the course of your business to whom you have paid the following during the year: at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest; at least $600 in rents, prizes and awards; any fishing boat proceeds; medical and health care payments; and various other income payments including, but not limited to, those to an attorney or nonqualified deferred compensation. You must also file Form 1099-MISC for each person from whom you have withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.

Take the stress out of tax time with the Office Depot Brand 1099-MISC Laser Tax Forms And Envelopes. These tax forms are made of acid-free paper and heat-resistant ink to help prevent yellowing and fading, and they're compatible with most accounting software programs for your convenience. File Form 1099-MISC for each person in the course of your business to whom you have paid the following during the year: at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest; at least $600 in rents, prizes and awards; any fishing boat proceeds; medical and health care payments; and various other income payments including, but not limited to, those to an attorney or nonqualified deferred compensation. You must also file Form 1099-MISC for each person from whom you have withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.

- Red

- Black

- Acid-free

- Carbonless

- Heat Resistant Ink